Are you pouring your heart into caring for children but feeling unprotected when it comes to your business? Do you ever worry about accidents, injuries, or liability issues catching you off guard? What would happen if a child gets hurt or your property is damaged, and you don’t have the right coverage? Running a daycare from your home is rewarding, but without proper home daycare insurance, one unexpected event could put everything you’ve built at risk.

Home daycare insurance is more than just paperwork. It is the backbone of a secure and responsible daycare business. Whether it’s a child tripping over a toy, an allergy reaction during snack time, or even a parent dispute, having insurance gives you financial protection and peace of mind. With the right policy, you’re not just shielding your home. You’re safeguarding your livelihood and the trust that families place in you.

In this guide, I’ll walk you through everything you need to know about home daycare insurance: why it matters, what types of coverage you need, how much it costs, and how to choose a plan that fits your daycare’s unique needs. Let’s dive in and make sure your passion is fully protected.

Why Home Daycare Insurance Is Non-Negotiable

Running a daycare at home isn’t just warm hugs and finger painting. It is a serious responsibility. You’re caring for children in an environment not originally built for business. That means things can, and sometimes do, go wrong. Fast.

Liability Is Real

Injuries, allergic reactions, or even simple accidents can result in lawsuits or insurance claims. Without adequate daycare liability insurance, a single incident could leave you personally responsible for thousands of dollars in legal fees or medical bills. Whether it’s a child slipping on a wet floor or an accusation of improper supervision, the financial consequences can be devastating.

Homeowner’s Insurance Won’t Cover You

Many providers assume their existing homeowner’s policy will cover daycare-related incidents—it won’t. Once your residence is used for paid childcare, it qualifies as a business, and homeowners’ insurance typically excludes business liability. You need in-home daycare insurance or home daycare liability insurance to cover injuries, property damage, or claims that arise during daycare operations.

Peace of Mind for You—and the Parents

Today’s parents expect professionalism and accountability. Most will request proof of home daycare insurance before placing their child in your care. Carrying the proper home childcare insurance shows that you take your responsibilities seriously and adds legitimacy to your daycare business. It also gives you peace of mind, knowing that you’re protected if anything unexpected happens.

When you invest in the right insurance, you’re doing more than just checking a box—you’re committing yourself, your business, and the families who depend on you.

Types of Home Daycare Insurance You Need

Not all insurance is created equal, especially when it comes to running a daycare from home. To truly protect your business, your property, and the children in your care, you’ll need more than just a basic policy. The right home daycare insurance is usually made up of multiple coverage types that work together like layers of protection.

Let’s break down the 3 types of home daycare insurance you need to operate safely and professionally.

1. General Liability Insurance

This is the foundation of any daycare liability insurance plan. It protects you if a child gets injured or property gets damaged while under your care. For example, if a toddler bumps their head on a table or slips on your stairs, liability insurance for daycare can cover medical bills, legal fees, and potential settlements.

It also helps if a child damages property or if a parent claims your actions led to harm, even if it wasn’t your fault. Without this, even a minor incident can spiral into a costly legal battle.

2. Professional Liability Insurance (Errors & Omissions)

What if a parent accuses you of failing to supervise their child properly? Or claims you made a mistake in following care instructions? Professional liability insurance, also known as errors and omissions (E&O) coverage, protects you in these situations.

It covers allegations of negligence, failure to provide proper care, or unintentional mistakes in your services, even if the claims are false. This type of insurance is especially important for in-home daycares, where providers manage everything from safety and education to communication and daily routines, often without staff support.

3. Property Insurance

While liability policies protect against accidents and lawsuits, property insurance covers the physical things that make your daycare run. Think furniture, learning materials, craft supplies, educational toys, and even kitchen appliances used for food prep.

For example, if there’s a fire or flood—or even theft, home daycare insurance coverage can help replace what was lost so you can reopen quickly.

Some daycare insurance policies also offer business interruption coverage, which can help cover lost income while you recover from a covered event. That’s vital when every day of closure means lost trust and lost revenue.

How Much Does Home Daycare Insurance Cost?

The cost of home daycare insurance depends on several key factors. These include the number of children enrolled, your location, the level of coverage you choose, and your licensing status. Providers in urban or high-risk areas may pay more, while small, low-capacity daycare operations in rural regions may see lower rates.

Here is a general pricing range for common coverage types:

- General Liability Insurance: Typically costs between $350 and $1,000 per year, depending on limits, deductibles, and local legal requirements.

- Professional Liability Insurance: Adds around $300 to $700 per year, depending on whether you operate alone or with staff.

- Property Insurance: Costs between $200 and $500 annually. This covers toys, educational materials, furniture, and equipment.

- Abuse and Molestation Coverage (optional): This essential add-on may increase your premium by $100 to $300 annually, depending on the provider.

- Workers’ Compensation Insurance: Required in many regions if you have employees. Pricing ranges from $500 to $1,500 per year, based on payroll and local laws.

Most in-home daycare insurance policies are bundled. Providers can often receive discounts for combining multiple types of coverage.

How to Choose the Right Insurance for Your Home Daycare

Selecting the right home daycare insurance policy involves more than just comparing price tags. You’ll need to consider your operational scale, risk level, legal obligations, and the unique nature of the children you serve.

Here’s a structured approach to help guide your decision:

- Evaluate Your Risks: Consider the age groups you care for, daily activities, and any specialized equipment or routines. More complexity often requires broader protection.

- Understand Your Legal Obligations: Check with your local or state licensing authority to identify minimum insurance requirements. Many jurisdictions require daycare liability insurance as a condition for licensure.

- Compare Policies and Providers: Get quotes from both general insurers and those who specialize in childcare insurance. Look beyond the premium and carefully review what each policy actually covers, especially the exclusions and claim limits.

- Look for Extra Protections: Business interruption coverage, abuse protection, and commercial auto add-ons may not be required, but they are worth considering if your daycare involves higher levels of responsibility or parent interaction.

- Assess Discounts and Incentives: Some home daycare insurance companies offer discounts for safe operations, completed CPR or early childhood certifications, or bundling multiple coverages.

- Read the Policy in Detail: Ensure you understand deductibles, claim processes, and what situations are not covered. Being informed upfront can prevent costly surprises later.

- Consult a Professional: If you’re unsure, speak with a licensed broker or insurance advisor who has experience in the childcare sector. They can guide you toward a compliant, cost-effective plan based on your needs.

Choosing the right insurance ensures you are not only meeting local and state requirements but also strengthening your reputation with families. In an industry built on trust, a reliable insurance plan supports your professional image and protects the business you have worked hard to build.

What Activities Does Home Daycare Insurance Cover?

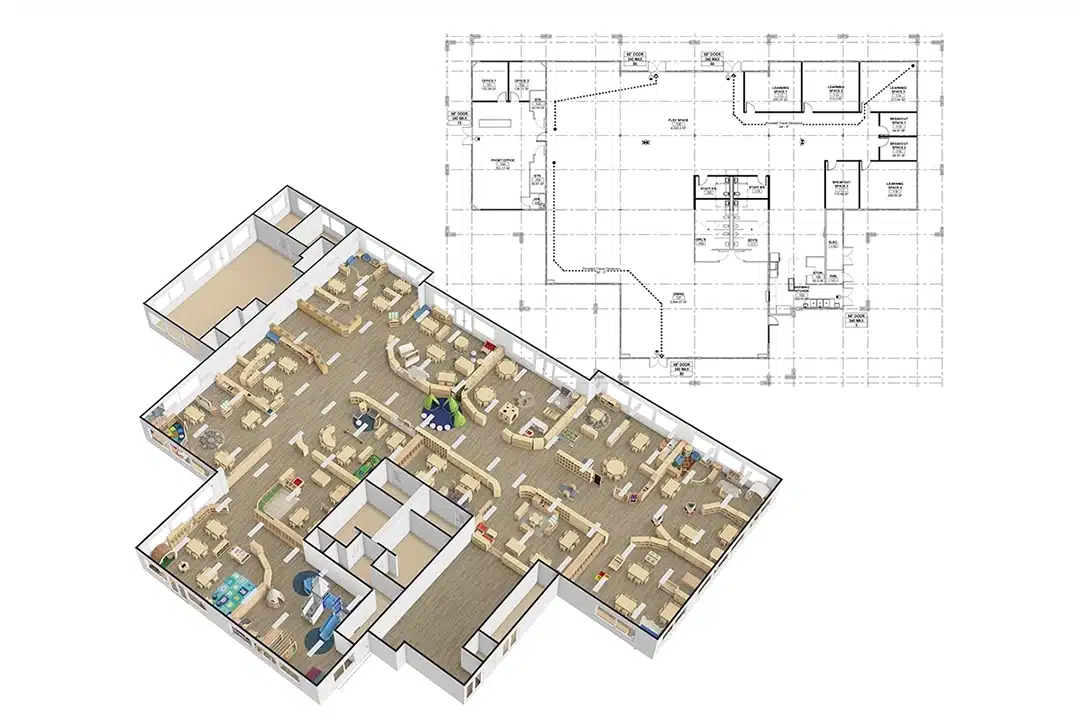

Home daycare insurance protects you during everyday childcare activities—from playtime and meals to naps and learning activities. But here’s what many providers don’t realize: the right furniture and space design can dramatically reduce your risk of claims in the first place.

Play and Learning Activities

What’s Covered:

Injuries during indoor/outdoor play, arts and crafts, sensory activities, circle time, and educational games.

How Furniture Design Reduces Risk:

- Rounded-edge tables prevent head injuries during active play

- Stable, anti-tip storage units eliminate falling hazards near climbing areas

- Low, open shelving allows proper supervision and reduces blind spots

- Non-slip mats under play areas minimize fall injuries

Most common claim: Falls and bumps during play. Our ASTM-certified furniture features impact-absorbing edges and stability-tested construction.

[View Safety-First Furniture Collection →]

Meals, Snacks, and Allergy Management

What’s Covered:

Allergic reactions, foodborne illness claims, choking incidents during meals.

How Furniture Design Reduces Risk:

- Age-appropriate table heights ensure proper seating and reduce choking risk

- Easy-to-clean surfaces (non-porous materials) prevent cross-contamination

- Designated allergen-free zones with separate storage cubbies

- Visual allergy labels built into personalized storage systems

Always document allergies—and store allergen-free snacks in clearly labeled, dedicated compartments.

[See Our Meal & Storage Solutions →]

What Insurance Usually Doesn’t Cover (But Good Furniture Can Prevent)

While insurance excludes intentional harm, unlicensed caregivers, and activities outside your license, proactive furniture choices can prevent many “gray area” claims:

Not Covered: Equipment misuse

Prevention: Furniture designed for specific age groups with built-in safety features

Not Covered: Injuries in unlicensed spaces

Prevention: Modular furniture systems that define and organize licensed areas clearly

Not Covered: Claims from non-compliant setups

Prevention: Pre-certified furniture with included compliance documentation

Home Daycare Insurance FAQs

Is a home daycare considered a commercial business?

Yes. Even if you’re running it from your residence, a home daycare is classified as a commercial business once you accept payment for childcare services. This classification means your personal homeowners insurance likely won’t cover daycare-related incidents—you’ll need home daycare insurance specifically designed for business use.

Is it a must to get home child care insurance?

It may not be legally required in every state, but it’s strongly recommended—and often mandatory for licensing. Home child care insurance protects your finances, your property, and the children in your care. Without it, a single accident or lawsuit could put your business and personal assets at serious risk.

What insurance is needed to open a child daycare school?

To open a licensed daycare or childcare school, you’ll typically need:

- General liability insurance

- Professional liability (errors and omissions) insurance

- Property insurance

- Abuse and molestation coverage (optional but highly recommended)

- Workers’ compensation (if you hire staff)

State and local requirements may vary. Always confirm with your licensing agency to ensure compliance.

What’s covered under errors and omissions insurance?

Errors and omissions (E&O) insurance—also called professional liability insurance—covers:

- Allegations of negligence

- Claims of failure to supervise

- Mistakes in following care plans or safety protocols

- Documentation errors or miscommunication with parents

Even if the claims are false, E&O insurance helps cover legal defense costs and settlements.

What happens if I don’t have insurance and a child gets hurt?

Without home daycare liability insurance, you could be held personally responsible for:

- Medical bills

- Legal fees

- Court-ordered damages

Your homeowners’ insurance will likely deny the claim, and you may have to pay out of pocket. This could jeopardize your business and personal financial security.

Does daycare insurance cover my toys and furniture?

Yes—if your policy includes property insurance. This covers items like:

Make sure your home daycare insurance coverage includes property protection in case of fire, theft, or accidental damage.

Can daycare insurance help if I’m accused of negligence?

Absolutely. That’s exactly what professional liability insurance is for. If a parent accuses you of negligence, such as not supervising a child properly or failing to follow instructions, your insurance can cover:

- Legal defense costs

- Settlement payouts

- Reputational damage control

This protection is critical for in home daycares, where caregivers handle multiple roles alone.

Conclusion

Navigating the world of home daycare insurance can seem overwhelming at first, but it’s one of the most important foundations of running a responsible and sustainable in-home childcare business. From understanding liability coverage and professional protections to comparing costs and meeting regional licensing requirements, the right policy acts as both a shield and a signal—to parents, regulators, and your peace of mind—that your daycare is secure, professional, and fully prepared. By evaluating your risks, operational scope, and local laws, you can build a coverage plan that protects your business, your property, and the children entrusted to your care.

Of course, insurance alone doesn’t create a safe, nurturing daycare environment. The physical setup—your space, layout, and furnishings—also plays a critical role in minimizing risk and maximizing comfort. Many providers take the extra step of investing in certified, child-safe furniture that supports both daily activities and regulatory compliance. At Xiha Montessori, we understand how important this balance is. As a trusted global manufacturer of daycare furnishings, we help daycare owners create functional, secure environments that work hand-in-hand with their insurance policies—because when safety and quality meet, real peace of mind begins.

Disclaimer

This article is for informational purposes only and does not constitute legal, financial, or insurance advice. Always consult with a licensed insurance provider or legal advisor in your region to ensure your home daycare insurance meets all applicable local and state requirements.